Data annotation

Get ready to boost your data with precision! At Tinkogroup, we specialize in making your data brighter by delivering data annotation services. Let’s annotate the future together!

Our skilled team provides essential data annotation and entry in insurance industry. We aim to help you effectively manage and analyze your data, enabling boosted business operations.

Get ready to boost your data with precision! At Tinkogroup, we specialize in making your data brighter by delivering data annotation services. Let’s annotate the future together!

Our expert team ensures your data is accurately labeled so you can focus on innovation. If you’re a researcher or a business owner, we’re here to simplify the process and maximize your results. Let’s get started!

Facilitating your data entry solutions starts here, where detailed accuracy meets swift execution. Let’s transform your information into actionable insights together!

Partnering with us means gaining access to comprehensive B2B lead research services in USA and beyond. Let our dedicated team provide high-quality lead lists to drive your business forward!

Our strategic approach in B2B email list building services ensures that you reach the right audience at the right time, maximizing your marketing efforts and enhancing your brand’s presence.

Our team of skilled Internet researchers is here to help you find the information you need quickly and efficiently. Let us simplify your search and guide you through the digital maze!

With our advanced tools and deep expertise, you can achieve your business success. At Tinkogroup, our insurance data entry and annotation services cover many clients within the insurance industry.

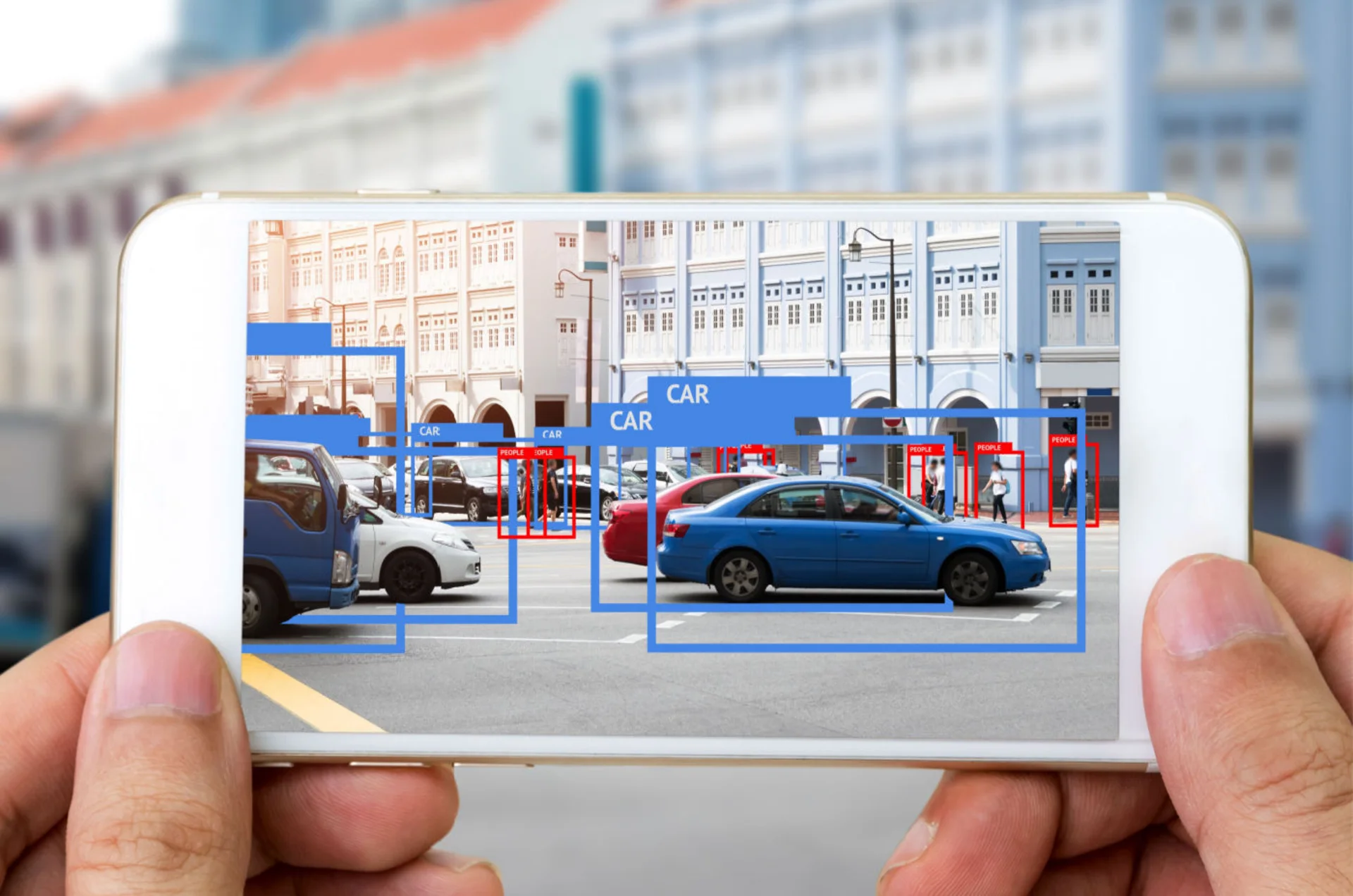

The project centered on image annotation tasks utilizing the Labelbox tool, where a wide range of objects (such as buildings, trees, cars, poles, containers, roofs, and empty lots) were meticulously labeled. This attention to detail was crucial for creating accurate labels. As a result, we enhanced the quality of the annotated data, thereby improving the effectiveness of future analyses and applications.

Working with Tinkogroup provides many advantages for insurance companies. Our data annotation for insurance industry helps manage data more efficiently and accurately, allowing you to boost your business performance.

We offer flexible insurance data annotation to each insurance company's unique needs and practical support.

Our services are budget-friendly, helping you lower operational costs while maintaining high-quality results.

At Tinkogroup, we integrate data sources to provide a holistic view of your operations and customer behavior.

Our services can easily scale with your business growth, ensuring agility and responsiveness in a changing market.

We use the latest tools in insurance data analytic and processing to ensure your projects benefit from top solutions.

Our expert team provides exceptional customer service and guidance, ensuring you receive the necessary assistance.

We value our clients’ experiences with our data labeling services for insurance industry. Their feedback highlights the effectiveness of our services and continuous improvement efforts.

They also show a great ability to understand and get up to speed on more complex industry knowledge

We're satisfied with how our collaboration has gone.

The quality and speed of their work exceeded our expectations.

The team showcased flexibility in accommodating unforeseen circumstances or changing project dynamics.

I'm mostly impressed by Tinkogroup's young and enthusiastic staff.

I had a great experience working with them. Their work was of great quality, they were always responsive, and they delivered the project on time. I highly recommend their services to anyone in need of assistance.

Cuboid annotation, also known as 3D Bounding Box annotation, is often described as a natural evolution of 2D annotation into…

The term “human pose estimation” sounds deceptively simple today. It gives the impression that it is just another pose estimation…

In recent years, data has become a strategic asset for companies of all sizes and industries. But high-quality market analysis,…

The insurance industry uses data to assess risk, price policies, detect fraud, and improve customer service. By analyzing data, insurers can more accurately predict potential claims, personalize policies, and ensure they remain competitive.

Data annotation is essential for insurance companies as it helps organize and label large volumes of unstructured data, making it usable for machine learning models. Properly annotated data enables AI systems to automate claims processing, detect fraud, and assess risk more accurately.

Insurance companies gather data from various sources, including customer applications, policyholder records, claims reports, medical records, vehicle data, and public records. Additionally, they use third-party data providers for demographic, financial, and risk-related information.

Tell us about your project